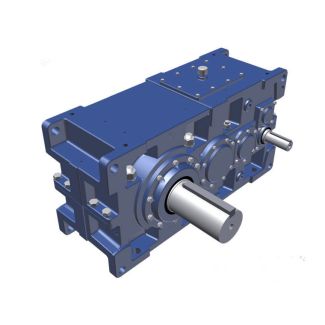

euro tech asia international sdn bhd H2DH-24-C Helical gearboxes H2

In stock

SKU

H2DH-24-C

$278,571.43

Flender/Flender Gear Units/Helical gearboxes H2

al homeowners. The real estate tax however, has not been put on the legislation agenda for this year, with Beijing warned to exercise caution because it has the potential to impact wide range of industries and households, as well as

warned to exercise caution because it has the potential to impact wide range of industries and households, as well as  the countrys financial and social stability. joint symposium, which included the Ministry of Finance and Ministry of Housing and Urban-Rural

the countrys financial and social stability. joint symposium, which included the Ministry of Finance and Ministry of Housing and Urban-Rural  Development, heard opinions from municipal officials and experts about the current real estate tax reform pilot programme, further increasing speculation

Development, heard opinions from municipal officials and experts about the current real estate tax reform pilot programme, further increasing speculation  on the outlook for property taxation in more Chinese cities. Theres no doubt that it will be levied, said Cai Chang, tax professor at Central University of Finance and Economics. The only issue is how. Due to the lack of availability of housing information systems as well as questions about the legitimacy of such move, Beijings proposed taxation on property owners has received strong opposition for the past decade, as the land which house is built on is already owned by the state. number of exemptions for ordinary households, particularly those living in the only flat they own, to facilitate early implementation, were often involved in previous discussions. Shenzhen city and Hainan province could be testing grounds for it, with both of them frontiers of Chinas reforms, experts said. The southern tech hub of Shenzhen should be the first candidate for the pilot programme, due to its runaway home prices in heavily speculated market, according to the Chinese Academy of Social Sciences (CASS). The tax scheme roll-out in the balmy Investment china urgeD To push aheaD wiTh conTroversial properTy aX an inevitable solution to local debt crisisInvestment southern island of Hainan would be much easier with its largely regulated property market meaning less resistance for implementation, another expert said. The current programme in Chongqing and Shanghai mainly target villas and high-end property owners, with big cities with runaway hom

on the outlook for property taxation in more Chinese cities. Theres no doubt that it will be levied, said Cai Chang, tax professor at Central University of Finance and Economics. The only issue is how. Due to the lack of availability of housing information systems as well as questions about the legitimacy of such move, Beijings proposed taxation on property owners has received strong opposition for the past decade, as the land which house is built on is already owned by the state. number of exemptions for ordinary households, particularly those living in the only flat they own, to facilitate early implementation, were often involved in previous discussions. Shenzhen city and Hainan province could be testing grounds for it, with both of them frontiers of Chinas reforms, experts said. The southern tech hub of Shenzhen should be the first candidate for the pilot programme, due to its runaway home prices in heavily speculated market, according to the Chinese Academy of Social Sciences (CASS). The tax scheme roll-out in the balmy Investment china urgeD To push aheaD wiTh conTroversial properTy aX an inevitable solution to local debt crisisInvestment southern island of Hainan would be much easier with its largely regulated property market meaning less resistance for implementation, another expert said. The current programme in Chongqing and Shanghai mainly target villas and high-end property owners, with big cities with runaway hom| Model Type | Helical gearboxes H2 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 13000.000000 |

| Ratio Range | 1 : 7.1…22.4 |

| Low Speed Output | Hollow shaft with shrink disk |

| Nominal Torque | 725000 Nm |

| Mounting Arrangements | Horizontal mounting position |

| Manufacturer | A. Friedr. Flender GmbH |

| Country of Manufacture | Netherlands |

| Data Sheet & Drawings | euro tech asia international sdn bhd H2DH-24-C Helical gearboxes H2 |