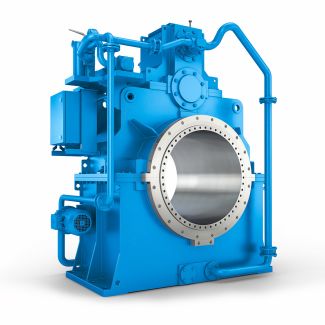

wer rating s of gear unit sizes to Technical spe B2SV-16-C Bevel-helical speed reduction gearboxes B2

In stock

SKU

B2SV-16-C

$13,392.86

Flender/Flender Gear Units/Bevel-helical speed reduction gearboxes B2

ll, according to the PW/IPG analysis. However, the profit and cash flow potential of the mill is highly sensitive to the average price of sugar which can not be accurately projected. . Estimated Value of Victoria de Julio The assets

the average price of sugar which can not be accurately projected. . Estimated Value of Victoria de Julio The assets  that are included in the financial valuation are the productive assets of the enterprise only. These assets include the sugar

that are included in the financial valuation are the productive assets of the enterprise only. These assets include the sugar  mill, 8,9 manzanas of developed land, 3,0 manzanas of undeveloped land, 3,8 manzanas of forested land, 5,0 manzanas of other

mill, 8,9 manzanas of developed land, 3,0 manzanas of undeveloped land, 3,8 manzanas of forested land, 5,0 manzanas of other  land, the electric generation facilities, and all equipment and inventories associated with these assets. Two methods were used to estimate the value of Ingenio Victoria de Julio ("IVJ"): the Discounted Cash Flow ("DCF") method and the liquidation value of IVJ assets. 1. Discounted Cash Flow Valuation The DCF method is considered the best method for estimating the value of IVJ as an ongoing enterprise. The DCF analysis was performed by projecting expected future cash flows and converting the cash flows into their present values using discount rate that reflects the riskiness of the cash flows. The analysis assumes that IVJ will not have to repay any of the debt currently on its balanLe sheet after privatization. IVJ is currently operating at loss and if it continues to be operated as it is now, the mill' value as an ongoing concern is zero. In order to become profitable, IVJ must implement operating improvements and increase the volume of cane that is processed in the mill. Under these conditions, the DCF analysis indicates that the mill could have positive value of 4 to 1 million cordobas ($9 to $2 million). In order to achieve the higher end of the DCF range, substantial capital investments would be required to improve operations, expand cultivated land, and expand energy generation. oiII 2. Liquidation Value The liquidation value of IVJ is the price that could be achieved through an orderly sale of all the assets available to be privatized. The liquidation va

land, the electric generation facilities, and all equipment and inventories associated with these assets. Two methods were used to estimate the value of Ingenio Victoria de Julio ("IVJ"): the Discounted Cash Flow ("DCF") method and the liquidation value of IVJ assets. 1. Discounted Cash Flow Valuation The DCF method is considered the best method for estimating the value of IVJ as an ongoing enterprise. The DCF analysis was performed by projecting expected future cash flows and converting the cash flows into their present values using discount rate that reflects the riskiness of the cash flows. The analysis assumes that IVJ will not have to repay any of the debt currently on its balanLe sheet after privatization. IVJ is currently operating at loss and if it continues to be operated as it is now, the mill' value as an ongoing concern is zero. In order to become profitable, IVJ must implement operating improvements and increase the volume of cane that is processed in the mill. Under these conditions, the DCF analysis indicates that the mill could have positive value of 4 to 1 million cordobas ($9 to $2 million). In order to achieve the higher end of the DCF range, substantial capital investments would be required to improve operations, expand cultivated land, and expand energy generation. oiII 2. Liquidation Value The liquidation value of IVJ is the price that could be achieved through an orderly sale of all the assets available to be privatized. The liquidation va| Model Type | Bevel-helical speed reduction gearboxes B2 |

|---|---|

| Gear Type | Bevel Helical Gear |

| Weight (kg) | 625.000000 |

| Ratio Range | 1 : 5.6…20 |

| Low Speed Output | Solid shaft with parallel key acc. to DIN 6885/1 |

| Nominal Torque | 148000 Nm |

| Mounting Arrangements | Vertical mounting position |

| Manufacturer | Flender GmbH |

| Country of Manufacture | Cambodia |

| Data Sheet & Drawings | wer rating s of gear unit sizes to Technical spe B2SV-16-C Bevel-helical speed reduction gearboxes B2 |