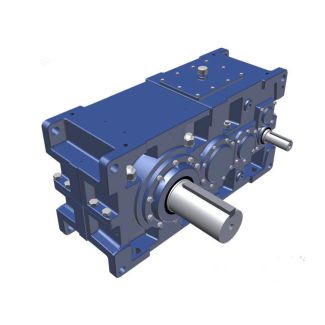

H4-VV-27-A luggable and easy to install The elastomer eleme Helical gearboxes H4

In stock

SKU

H4-VV-27-A

$254,571.43

Flender/Flender Gear Units/Helical gearboxes H4

ges," Metalworking News, Aug. 1, 1, pp. 1 and 5. to firms in developing industries, more favorable depreciation schedules for new equipment purchases and other special tax incentives to stimulate economic growth, andproduct liability regulations, as well as number of

new equipment purchases and other special tax incentives to stimulate economic growth, andproduct liability regulations, as well as number of  other programs. According to industry sources, some programs and policies are major disincentives for .. gear manufacturers. Such .. Government

other programs. According to industry sources, some programs and policies are major disincentives for .. gear manufacturers. Such .. Government  policies include the .. export control system, the Foreign Corrupt Practices Act, antiboycott statutes, the taxation of export income, lack

policies include the .. export control system, the Foreign Corrupt Practices Act, antiboycott statutes, the taxation of export income, lack  of funding of the Export-Import Bank and other export financing/promotion programs, and the policies of such regulatory bodies as the Environmental Protection Agency and the Occupational Safety and Health Administration. 4 In many instances, government programs do not specifically target the gear and gear products industries; rather, they are directed at manufacturing in general or at an industry as whole. .. gear and gear products producers were asked to report actions' the government - Federal, State, and local-has taken to enhance their competitiveness. According to questionnaire responses, the most common actions included: ( some form of business loan, generally at low rate of interest; ( low interest or tax-free revenue bonds; ( State or local tax abatement programs; ( State funding for manpower training; and ( tax incentives (including depreciation and credits) for investment, employee stock option plans, and research. Export Financing Export sales may depend on the seller' ability to provide financial assistance or favorable payment terms to the purchaser. In the United States, companies look to the Export-Import Bank or commercial banks for assistance. This has become more important alternative since commercial banks, in attempting to reduce lending risk, have curtailed many such loans. However, the Export-Import Bank has had severe cutbacks in its direct loan b

of funding of the Export-Import Bank and other export financing/promotion programs, and the policies of such regulatory bodies as the Environmental Protection Agency and the Occupational Safety and Health Administration. 4 In many instances, government programs do not specifically target the gear and gear products industries; rather, they are directed at manufacturing in general or at an industry as whole. .. gear and gear products producers were asked to report actions' the government - Federal, State, and local-has taken to enhance their competitiveness. According to questionnaire responses, the most common actions included: ( some form of business loan, generally at low rate of interest; ( low interest or tax-free revenue bonds; ( State or local tax abatement programs; ( State funding for manpower training; and ( tax incentives (including depreciation and credits) for investment, employee stock option plans, and research. Export Financing Export sales may depend on the seller' ability to provide financial assistance or favorable payment terms to the purchaser. In the United States, companies look to the Export-Import Bank or commercial banks for assistance. This has become more important alternative since commercial banks, in attempting to reduce lending risk, have curtailed many such loans. However, the Export-Import Bank has had severe cutbacks in its direct loan b| Model Type | Helical gearboxes H4 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 11880.000000 |

| Ratio Range | 1 : 100…355 |

| Low Speed Output | Solid shaft with parallel key acc. to DIN 6885/1 with reinforced spigot |

| Nominal Torque | 1230000 Nm |

| Mounting Arrangements | Vertical mounting position |

| Manufacturer | Flender France S.A.R.L. |

| Country of Manufacture | Belize |

| Data Sheet & Drawings | H4-VV-27-A luggable and easy to install The elastomer eleme Helical gearboxes H4 |