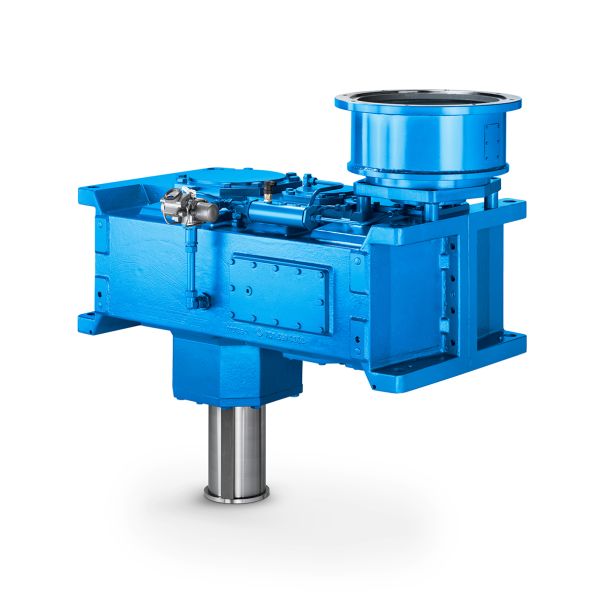

Helical gear Reduction Boxes H3 flender drives private limited sriperumbudur H3-VV27-B

In stock

SKU

H3-VV27-B

$486,428.57

Flender/Flender Gear Units/Helical gear Reduction Boxes H3

d users' demand for gears has declined, the unprecedented demand for large civil transports has increased the overall consumption of aerospace gears. Market Size The .. aerospace industry accounted for approximately 5 percent of total .. gear consumption during 1-8.

aerospace gears. Market Size The .. aerospace industry accounted for approximately 5 percent of total .. gear consumption during 1-8.  International agreements for the production of gears, as shown in the following tabulation, contributed to near doubling in imports, from

International agreements for the production of gears, as shown in the following tabulation, contributed to near doubling in imports, from  $2 million to $5 million during 1-8. However, imports have not been significant factor in the .. market. They accounted

$2 million to $5 million during 1-8. However, imports have not been significant factor in the .. market. They accounted  for only 3 to 6 percent of consumption during 1-8. The United States remains the preeminent supplier of aerospace gears due to its lead in manufacturing technology and the existence of large .. market for these gears. Apparent Ratio of imports Year Imports consumption to consumption Million dollars Percent 1 2.0 7.9 3.4 1 3.6 6.8 4.4 1 3.5 8.0 4.7 1 4.6 8.3 5.0 1 4.5 8.4 5.9 Suppliers to the Market The .. aerospace gear market is dominated by 1 manufacturers. These companies account for nearly 9 percent of all aerospace gearing sold in the United States and are identified in table 6-4. Nine of these firms are subsidiaries of Fortune 5 companies. Others, like ..-based Lucas-Western and the Canadian firms of Pratt & Whitney Canada and Spar, are either foreign owned or do not have domestic .. production facilities. These gear manufacturers are either prime contractors or subcontractors. Prime contractors sell both defense and commercial products to variety of end users including the .. Government, corporations, individuals, and airlines. Prime contractors customarily place large, long-term purchase orders with subcontractors. In many instances, these orders constitute an important share of the gear manufacturers' total sales. Subcontractors, such as Arrow and Litton, rely on prime contractors as their principal customers for aerospace gears. Aerospace producers, except most helicopter producers

for only 3 to 6 percent of consumption during 1-8. The United States remains the preeminent supplier of aerospace gears due to its lead in manufacturing technology and the existence of large .. market for these gears. Apparent Ratio of imports Year Imports consumption to consumption Million dollars Percent 1 2.0 7.9 3.4 1 3.6 6.8 4.4 1 3.5 8.0 4.7 1 4.6 8.3 5.0 1 4.5 8.4 5.9 Suppliers to the Market The .. aerospace gear market is dominated by 1 manufacturers. These companies account for nearly 9 percent of all aerospace gearing sold in the United States and are identified in table 6-4. Nine of these firms are subsidiaries of Fortune 5 companies. Others, like ..-based Lucas-Western and the Canadian firms of Pratt & Whitney Canada and Spar, are either foreign owned or do not have domestic .. production facilities. These gear manufacturers are either prime contractors or subcontractors. Prime contractors sell both defense and commercial products to variety of end users including the .. Government, corporations, individuals, and airlines. Prime contractors customarily place large, long-term purchase orders with subcontractors. In many instances, these orders constitute an important share of the gear manufacturers' total sales. Subcontractors, such as Arrow and Litton, rely on prime contractors as their principal customers for aerospace gears. Aerospace producers, except most helicopter producers| Model Type | Helical gear Reduction Boxes H3 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 22700.000000 |

| Ratio Range | 1 : 22.4…90 |

| Low Speed Output | Solid shaft with parallel key acc. to DIN 6885/1 with reinforced spigot |

| Nominal Torque | 1230000 Nm |

| Mounting Arrangements | Vertical mounting position |

| Manufacturer | A. Friedr. Flender AG & Co. KG |

| Country of Manufacture | Canada |

| Data Sheet & Drawings | Helical gear Reduction Boxes H3 flender drives private limited sriperumbudur H3-VV27-B |