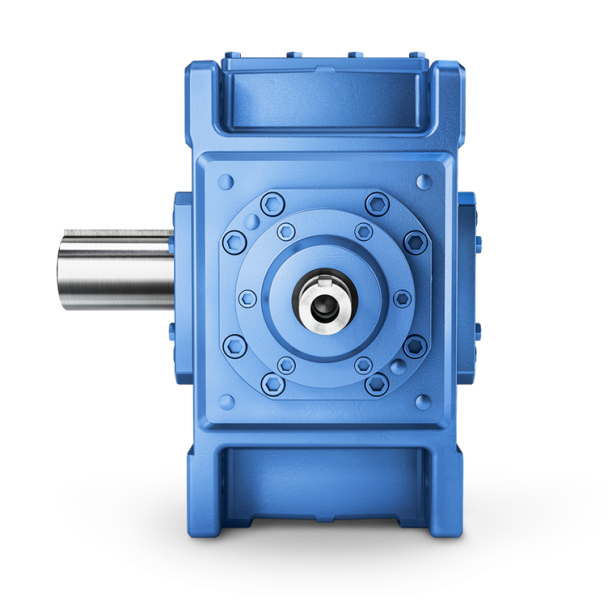

H3-SV-28B siemens flender gearbox catalogue pdf Helical gear units H3

In stock

SKU

H3-SV-28B

$546,428.57

Flender/Flender Gear Units/Helical gear units H3

cific environments. Switching costs arerelatively limited as the indicated requirements can be met by large number ofplayers. Vertically affected markets 2. Flender is an important supplier of mech anical power transmission equipment that is used by Siemens in number of

2. Flender is an important supplier of mech anical power transmission equipment that is used by Siemens in number of  downstream applications 8. Considering an EEA market comprising all gears, Flender ranks second with [1% - 2%] market share behind

downstream applications 8. Considering an EEA market comprising all gears, Flender ranks second with [1% - 2%] market share behind  SEW ([2% - 3%]). The other European competitors have market shares below 5%: Getriebebau-Nord ( [0% - 1%] ), Bonfliglioli

SEW ([2% - 3%]). The other European competitors have market shares below 5%: Getriebebau-Nord ( [0% - 1%] ), Bonfliglioli  ([0% - 1%]), Leroy Somer/Emerson ([0% - 1%]), Hansen ([ 0% - 1%]), Metso ([0% - 1%]), Demag ([0% - 1%]) and Renk ([0% - 1%]). When further segmenting according to thetorque level, Flender is the clear mark et leader for high torque gears ([2% - 3%]), with all other competitors having be low 5% market shares, apart from Renk ([0% - 1%]). The market investigation has confirmed Flenders establishedposition, but has not indicated that its in tegration into Siemens could lead to foreclosure effects or strengthen Flende rs market position, either on the overall gear market or on any of the gear application markets discussed below. 7 See case COMP/.3 Siemens/VA Tech 8 Siemens does not produce mechanical power transmi ssion equipment, apart from gears for incorporation in its own gear-type compressors and locomotives. Siemens does not sell these inputs to third parties 7() wind gear units 2. Siemens uses wind gear units in its wind turbines. Flender is the leading wind gear supplier with [4% - 5%] EEA market share (lower when assessed on the basis of global market). Competing wind turbine manufacturers have stated that theintegration of an important wind gear upplier into wind turbine competitor is reason for concern. However, all wind tu rbine manufacturers have confirmed that viable alternative European wind gear unit suppliers remain: Hansen ([1% - 2%]), Bosch-Rexroth ([1% - 2%]) and Metso ([0% - 1%]

([0% - 1%]), Leroy Somer/Emerson ([0% - 1%]), Hansen ([ 0% - 1%]), Metso ([0% - 1%]), Demag ([0% - 1%]) and Renk ([0% - 1%]). When further segmenting according to thetorque level, Flender is the clear mark et leader for high torque gears ([2% - 3%]), with all other competitors having be low 5% market shares, apart from Renk ([0% - 1%]). The market investigation has confirmed Flenders establishedposition, but has not indicated that its in tegration into Siemens could lead to foreclosure effects or strengthen Flende rs market position, either on the overall gear market or on any of the gear application markets discussed below. 7 See case COMP/.3 Siemens/VA Tech 8 Siemens does not produce mechanical power transmi ssion equipment, apart from gears for incorporation in its own gear-type compressors and locomotives. Siemens does not sell these inputs to third parties 7() wind gear units 2. Siemens uses wind gear units in its wind turbines. Flender is the leading wind gear supplier with [4% - 5%] EEA market share (lower when assessed on the basis of global market). Competing wind turbine manufacturers have stated that theintegration of an important wind gear upplier into wind turbine competitor is reason for concern. However, all wind tu rbine manufacturers have confirmed that viable alternative European wind gear unit suppliers remain: Hansen ([1% - 2%]), Bosch-Rexroth ([1% - 2%]) and Metso ([0% - 1%]| Model Type | Helical gear units H3 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 25500.000000 |

| Ratio Range | 1 : 25…100 |

| Low Speed Output | Solid shaft with parallel key acc. to DIN 6885/1 |

| Nominal Torque | 1400000 Nm |

| Mounting Arrangements | Vertical mounting position |

| Manufacturer | Flender GmbH |

| Country of Manufacture | China |

| Data Sheet & Drawings | H3-SV-28B siemens flender gearbox catalogue pdf Helical gear units H3 |