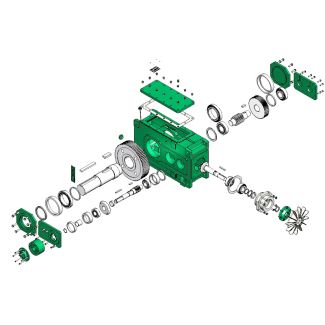

flender gear motor H3-DH-14B Helical gear units H3

In stock

SKU

H3-DH-14B

$56,250.00

Flender/Flender Gear Units/Helical gear units H3

e their capital "locked-up" in existing investments in older, long-held assets. 3 In comparison, the long-term capital gains tax rate in Japan is 5 percent; in Germany, South Korea, and Taiwan, it is zero. 3 3 Laura Pettey, "Minimum Tax:

in Japan is 5 percent; in Germany, South Korea, and Taiwan, it is zero. 3 3 Laura Pettey, "Minimum Tax:  Reform in Sight?," Issue Brief, National Association of Manufacturers, October 1, pp. 1-2. 3 USITC, Effects of Proposed Tax Reforms,

Reform in Sight?," Issue Brief, National Association of Manufacturers, October 1, pp. 1-2. 3 USITC, Effects of Proposed Tax Reforms,  USITC Publication 1, . 3. 3 Testimony of Ilona Hogan, on behalf of the American Gear Manufacturers Association, USITC hearing,

USITC Publication 1, . 3. 3 Testimony of Ilona Hogan, on behalf of the American Gear Manufacturers Association, USITC hearing,  Nov. 1, 1. 3 Bruce Bartlett, "Taxing and Spending Policies: The Fiscal Foundation for Competitiveness," ch. in Making America More Competitive (Washington, DC: The Heritage Foundation, , PP. 2-2. 3 Laura Pettey and Paul Huard, "The Case for Capital Gains Tax Reduction," Issue Brief, National Association of Manufacturers, September 1, . 1. 4-1 Some .. manufacturers also take exception to the manner in which the Act treats foreign tax credits. Before the Act, .. companies with overseas subsidiaries could consolidate their foreign income and obtain credit from the .. Government for the majority of the taxes that the corporation paid to other governments. Many claim that the Internal Revenue Service now requires elaborate breakdowns from ..-owned businesses that have plants in foreign countries based on their sources ofincome. This makes it more difficult to use foreign tax credits from one country to offset the foreign tax bills accumulated in another country. .. manufacturers state that this type of reporting means fewer places to protect foreign income and, as result, they have to pay higher effective .. tax rates. In addition, the .. Government taxes .. corporations on their worldwide income. Most foreign governments do not. Thus in Europe, for example, firms pay little or no tax to their home governments on any foreign income. Antitrust According to the AGMA, .. gear firms feel they are disadvantaged by .. antitrust and tra

Nov. 1, 1. 3 Bruce Bartlett, "Taxing and Spending Policies: The Fiscal Foundation for Competitiveness," ch. in Making America More Competitive (Washington, DC: The Heritage Foundation, , PP. 2-2. 3 Laura Pettey and Paul Huard, "The Case for Capital Gains Tax Reduction," Issue Brief, National Association of Manufacturers, September 1, . 1. 4-1 Some .. manufacturers also take exception to the manner in which the Act treats foreign tax credits. Before the Act, .. companies with overseas subsidiaries could consolidate their foreign income and obtain credit from the .. Government for the majority of the taxes that the corporation paid to other governments. Many claim that the Internal Revenue Service now requires elaborate breakdowns from ..-owned businesses that have plants in foreign countries based on their sources ofincome. This makes it more difficult to use foreign tax credits from one country to offset the foreign tax bills accumulated in another country. .. manufacturers state that this type of reporting means fewer places to protect foreign income and, as result, they have to pay higher effective .. tax rates. In addition, the .. Government taxes .. corporations on their worldwide income. Most foreign governments do not. Thus in Europe, for example, firms pay little or no tax to their home governments on any foreign income. Antitrust According to the AGMA, .. gear firms feel they are disadvantaged by .. antitrust and tra| Model Type | Helical gear units H3 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 2625.000000 |

| Ratio Range | 1 : 28…112 |

| Low Speed Output | Hollow shaft with shrink disk |

| Nominal Torque | 113000 Nm |

| Mounting Arrangements | Horizontal mounting position |

| Manufacturer | Siemens AG |

| Country of Manufacture | Germany |

| Data Sheet & Drawings | flender gear motor H3-DH-14B Helical gear units H3 |