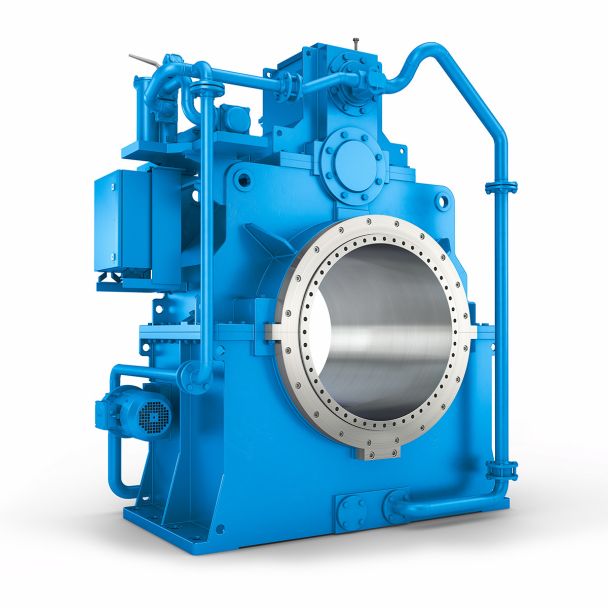

H1-HH-7-D n eupex couplings Helical gear reducer H1

In stock

SKU

H1-HH-7-D

$11,721.43

Flender/Flender Gear Units/Helical gear reducer H1

. 5-2 equipment, particularly "mechatronics" - industrial robots and NC manufacturing machinery-which will enable small- and medium- sized companies to become more efficient. The company has the choice of special initial depreciation of 3 percent of the acquisition cost or

become more efficient. The company has the choice of special initial depreciation of 3 percent of the acquisition cost or  tax credit of 7 percent of the acquisition cost The maximum amount of tax credit allowed is 2 percent of

tax credit of 7 percent of the acquisition cost The maximum amount of tax credit allowed is 2 percent of  the corporation' tax liability in the tax year. Other tax incentive provisions exist for & expenditures and for investing in

the corporation' tax liability in the tax year. Other tax incentive provisions exist for & expenditures and for investing in  energy efficient and pollution control equipment Most gears are imported duty-free. For most marine reduction gears, the import duty is 3.4 percent ad valorem, although Mal has asked the Government to eliminate this tariff altogether. 1 This action coincides with the Government' announced plan to increase imports through tax incentives, government loans and import credits. 1 Other competitive factors Japanese gear producers are competitive worldwide in most types of gearing. In the vehicle gearing area, especially automotive, Japanese transmission design and manufacturing expertise are used in providing products with competitive edge, such as cars with smoother and quieter transmissions. In industrial gearing, Japanese producers have enhanced existing products, but have not developed "modular' standardized products as have the Europeans. Japanese gear producers lag behind the Europeans in aerospace product design primarily because they have only recently begun to develop an aerospace industry. Expertise in aerospace gearing is growing largely through licensing agreements with .. and European producers. The issue of product liability is virtually unknown in the Japanese gear industry. Many small, independent gear producers manufacture gears to the customer' specification, and therefore product liability is not passed down to the gear producer. 1 For products manufactured under license, the product liability rests, for the mo

energy efficient and pollution control equipment Most gears are imported duty-free. For most marine reduction gears, the import duty is 3.4 percent ad valorem, although Mal has asked the Government to eliminate this tariff altogether. 1 This action coincides with the Government' announced plan to increase imports through tax incentives, government loans and import credits. 1 Other competitive factors Japanese gear producers are competitive worldwide in most types of gearing. In the vehicle gearing area, especially automotive, Japanese transmission design and manufacturing expertise are used in providing products with competitive edge, such as cars with smoother and quieter transmissions. In industrial gearing, Japanese producers have enhanced existing products, but have not developed "modular' standardized products as have the Europeans. Japanese gear producers lag behind the Europeans in aerospace product design primarily because they have only recently begun to develop an aerospace industry. Expertise in aerospace gearing is growing largely through licensing agreements with .. and European producers. The issue of product liability is virtually unknown in the Japanese gear industry. Many small, independent gear producers manufacture gears to the customer' specification, and therefore product liability is not passed down to the gear producer. 1 For products manufactured under license, the product liability rests, for the mo| Model Type | Helical gear reducer H1 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 547.000000 |

| Ratio Range | 1 : 1.25…5.6 |

| Low Speed Output | Hollow shaft with keyway acc. to DIN 6885/1 |

| Nominal Torque | 17800 Nm |

| Mounting Arrangements | Horizontal mounting position |

| Manufacturer | flanders electric peru s a c |

| Country of Manufacture | Haiti |

| Data Sheet & Drawings | H1-HH-7-D n eupex couplings Helical gear reducer H1 |