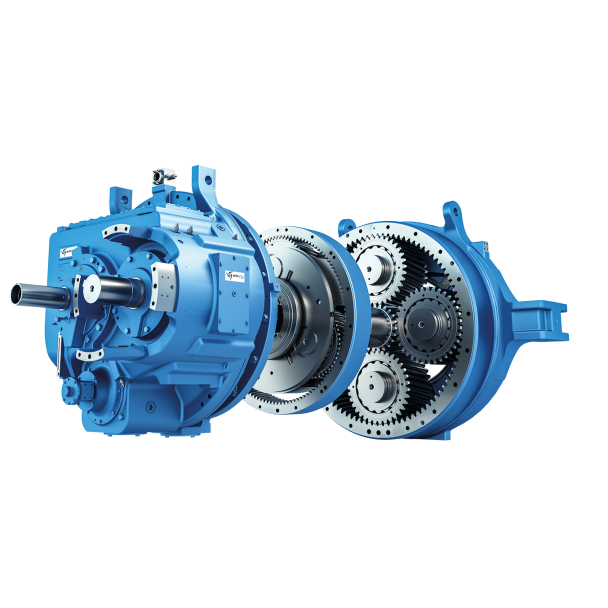

H2-VH-18B flender reducer catalog Helical gear reducer H2

In stock

SKU

H2-VH-18B

$109,821.43

Flender/Flender Gear Units/Helical gear reducer H2

1,3 Bank debt and overdrafts 2,0 1,5 2,1 1,2 Prepayments received 8,2 5,7 6,3 2,6 Trade creditors 6,9 4,7 4,5 2,6 Amounts owed to subsidiary undertakings - - 1,2 9,6 Note 9 Corporation tax 4,6 2,5 0 0 Other creditors

2,6 Amounts owed to subsidiary undertakings - - 1,2 9,6 Note 9 Corporation tax 4,6 2,5 0 0 Other creditors  3,3 5,3 1,8 3,2 Accrued expenses and deferred income 1,2 1,5 0 0 1,4,7 1,2,0 1,0,2 9,7 Total creditors 1,7,8

3,3 5,3 1,8 3,2 Accrued expenses and deferred income 1,2 1,5 0 0 1,4,7 1,2,0 1,0,2 9,7 Total creditors 1,7,8  1,4,1 1,1,4 1,1,9 TOTAL LIABILITIES 2,9,5 2,5,3 2,1,6 1,9,6 Note 2 Financial instruments Note 2 Rental and leasing obligations Note

1,4,1 1,1,4 1,1,9 TOTAL LIABILITIES 2,9,5 2,5,3 2,1,6 1,9,6 Note 2 Financial instruments Note 2 Rental and leasing obligations Note  2 Mortgages and securities Note 2 Contingent liabilities Note 2 Related parties Note 2 Group overview 4[Cash flow statement] DKK 0 Group 2 1 Profit/(loss) for the year 4,5 (6, Depreciation and write-downs 7,1 1,5 Note Other adjustments 1,5 4,7 Note Adjustments in working capital (1, (8, Cash flows from operations before financial items 1,8 (8, Financial expenses, net (4, (3, Cash flows from ordinary operations 7,9 (9, Corporation tax paid (3, (6,0) Cash flows from operating activities 3,2 (9, Note Investment in subsidiaries 0 (7, Investments in intangible fixed assets (6, (3,0)Investments in tangible fixed assets (2, (1,Investments in financial fixed assets (1, (1,Investment in other securities and participating interests, net 3 (Investment in wind farms, etc, net 4,9 (Sale of intangible fixed asset 2,2 2 Sale of tangible fixed assets 2,4 1,3 Sale of tangible fixed assets (2, (2, Financing from minority interests 2,7 5 Change in long-term debt 6,7 1,2 Share issue 1,2 6,8 Share issue, non-capital issue 5,1 0 Dividend paid 0 (1, Cash flows from financing activities 1,8 7,3 Changes in liquidity for the year (9, (3, Cash and cash equivalents, year start bank debt (7, 2,6 Cash and cash equivalents, year end bank debt (1, (7, The cash flow statement cannot be extracted directly from the published figures of the Group accounts. 4[Notes to the cash flow statement] DKK 0 Group 2 1 Note Other adjustments Minority interests share of the profit (5,

2 Mortgages and securities Note 2 Contingent liabilities Note 2 Related parties Note 2 Group overview 4[Cash flow statement] DKK 0 Group 2 1 Profit/(loss) for the year 4,5 (6, Depreciation and write-downs 7,1 1,5 Note Other adjustments 1,5 4,7 Note Adjustments in working capital (1, (8, Cash flows from operations before financial items 1,8 (8, Financial expenses, net (4, (3, Cash flows from ordinary operations 7,9 (9, Corporation tax paid (3, (6,0) Cash flows from operating activities 3,2 (9, Note Investment in subsidiaries 0 (7, Investments in intangible fixed assets (6, (3,0)Investments in tangible fixed assets (2, (1,Investments in financial fixed assets (1, (1,Investment in other securities and participating interests, net 3 (Investment in wind farms, etc, net 4,9 (Sale of intangible fixed asset 2,2 2 Sale of tangible fixed assets 2,4 1,3 Sale of tangible fixed assets (2, (2, Financing from minority interests 2,7 5 Change in long-term debt 6,7 1,2 Share issue 1,2 6,8 Share issue, non-capital issue 5,1 0 Dividend paid 0 (1, Cash flows from financing activities 1,8 7,3 Changes in liquidity for the year (9, (3, Cash and cash equivalents, year start bank debt (7, 2,6 Cash and cash equivalents, year end bank debt (1, (7, The cash flow statement cannot be extracted directly from the published figures of the Group accounts. 4[Notes to the cash flow statement] DKK 0 Group 2 1 Note Other adjustments Minority interests share of the profit (5,| Model Type | Helical gear reducer H2 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 5125.000000 |

| Ratio Range | 1 : 7.1…22.4 |

| Low Speed Output | Solid shaft with parallel key acc. to DIN 6885/1 with reinforced spigot |

| Nominal Torque | 230000 Nm |

| Mounting Arrangements | Horizontal mounting position |

| Manufacturer | A. Friedr. Flender AG & Co. KG |

| Country of Manufacture | Panama |

| Data Sheet & Drawings | H2-VH-18B flender reducer catalog Helical gear reducer H2 |