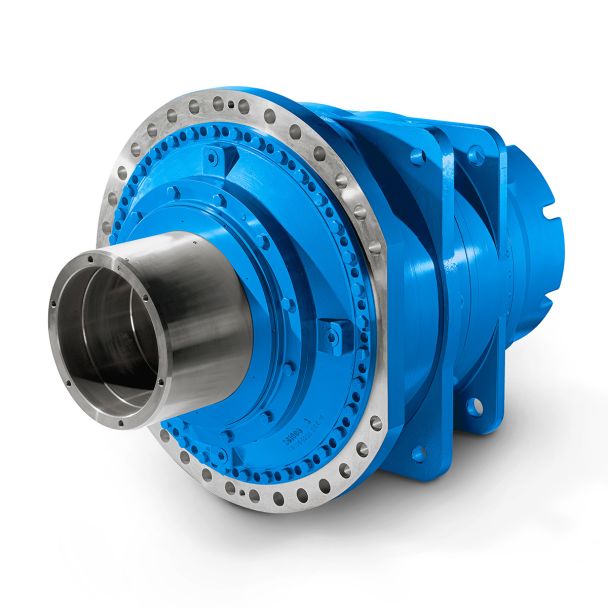

Flender/Flender Gear Units/Helical gear box H2

ba/$.. exchange rate. -9 Timing of Cash Flows All cash flows . assumed to be received or disbursed in the middle of the year in which they occur. Thus, all cash flows are discounted back to their present values from

middle of the year in which they occur. Thus, all cash flows are discounted back to their present values from  the middle of the fiscal year in which they occur to July 1, 1. * Exclusion of Debt The financial

the middle of the fiscal year in which they occur to July 1, 1. * Exclusion of Debt The financial  projections and DCF analysis exclude all costs of debt. -IO Ingenio Victoria de Julio Scenaio Discounted Cash Flow Analy. (OOOs

projections and DCF analysis exclude all costs of debt. -IO Ingenio Victoria de Julio Scenaio Discounted Cash Flow Analy. (OOOs  Cordobas) 0-Oct-9 1 1/9 1 1/9 1/9 1/9 1/9 IVJ Land (Manzanas) 8,6 8,6 8,5 8,6 8,6 8,6 Colono Land (Manzanas) 2,4 2,4 2,4 2,4 2,4 2,4 Total Land (Manzanas) 1,1 1,1 1,1 1,1 1,1 1,1 Agricultural Yield (Tons/Manzana) 3.2 3.2 3.2 3.2 3.2 3.2 Cane Harvested (Tons) 2,6 3,5 3,5 3,5 3,5.5 3,5 Cane Purchased (Tons) 8,7 9,2 9,2 9,2 9,2 9,2 Total Cane (Tons) 3,4 4,7 4,7 4,7 4,7 4,7 Industrial Yield (Quintals/Ton) 2.2 2.2 2.2 2.2 2.2 2.2 Sugar Produced (Quintals) 7,7 9,7 9,7 9,7 9,7 9,7 Average Porsonnel 1,8 1,8 1,8 1,8 1,8 1,8 Field Cost Per Ton ($US) $2.3 $2.0 $2.0 $2.0 $2.0 $2.0 Cash Operat. Cost Per Quirital ($US) $2.4 $1.2 $1.2 $1.2 $1.2 $1.2 1/9 1/9 1/9 . 1/9 1/9 1/9 REVENUES 8,7 8,7 8,7 8,7 8,7 OPERATING COSTS Field Costs Factory Costs Administrative Costs Depreciation 5,2 2,3 2,7 4,3 5,2 2,3 2,7 5,7 5,2 2,3 2,7 6,7 5,2 2,3 2,7 7,2 5,2 2,3 2,7 8,5 Total 9,6 9,0 9,0 9,5 1,9 PROFIT BEFORE TAX (1,9- (1, (1, (1, (2, TAX 2,2 2,2 2,2 2,3 2,3 PROFIT AFTER TAX (1, (1, (2. (2, (2, DEPRECIATION (+) 4,3 5,7 6,7 7,2 8,5 CAPITAL EXPENDITURES(-) 1,0 1,0 1,0 1,0 1,0 INCREASE IN NET WORKING CAPITAL (-) 1,9 0 0 0 0 CASH FLOW BEFORE LEVERAGE (2, (2, (2, (2, (2, NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% (8, TERMINAL VALUE * 0 NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% 0 FIRM .ALUE BEFORE LEVERAGE (8, Sensitivity Analysis of Firm Value Before Leverage Discount Rate 1% 1% 2% Average 9/9 6.9 (1, (1, (1, Sugar Price Hist. 7.0 (8, (8, (7, +5% 8.0 (7,0) (7, (6,6 The terminal value is th

Cordobas) 0-Oct-9 1 1/9 1 1/9 1/9 1/9 1/9 IVJ Land (Manzanas) 8,6 8,6 8,5 8,6 8,6 8,6 Colono Land (Manzanas) 2,4 2,4 2,4 2,4 2,4 2,4 Total Land (Manzanas) 1,1 1,1 1,1 1,1 1,1 1,1 Agricultural Yield (Tons/Manzana) 3.2 3.2 3.2 3.2 3.2 3.2 Cane Harvested (Tons) 2,6 3,5 3,5 3,5 3,5.5 3,5 Cane Purchased (Tons) 8,7 9,2 9,2 9,2 9,2 9,2 Total Cane (Tons) 3,4 4,7 4,7 4,7 4,7 4,7 Industrial Yield (Quintals/Ton) 2.2 2.2 2.2 2.2 2.2 2.2 Sugar Produced (Quintals) 7,7 9,7 9,7 9,7 9,7 9,7 Average Porsonnel 1,8 1,8 1,8 1,8 1,8 1,8 Field Cost Per Ton ($US) $2.3 $2.0 $2.0 $2.0 $2.0 $2.0 Cash Operat. Cost Per Quirital ($US) $2.4 $1.2 $1.2 $1.2 $1.2 $1.2 1/9 1/9 1/9 . 1/9 1/9 1/9 REVENUES 8,7 8,7 8,7 8,7 8,7 OPERATING COSTS Field Costs Factory Costs Administrative Costs Depreciation 5,2 2,3 2,7 4,3 5,2 2,3 2,7 5,7 5,2 2,3 2,7 6,7 5,2 2,3 2,7 7,2 5,2 2,3 2,7 8,5 Total 9,6 9,0 9,0 9,5 1,9 PROFIT BEFORE TAX (1,9- (1, (1, (1, (2, TAX 2,2 2,2 2,2 2,3 2,3 PROFIT AFTER TAX (1, (1, (2. (2, (2, DEPRECIATION (+) 4,3 5,7 6,7 7,2 8,5 CAPITAL EXPENDITURES(-) 1,0 1,0 1,0 1,0 1,0 INCREASE IN NET WORKING CAPITAL (-) 1,9 0 0 0 0 CASH FLOW BEFORE LEVERAGE (2, (2, (2, (2, (2, NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% (8, TERMINAL VALUE * 0 NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% 0 FIRM .ALUE BEFORE LEVERAGE (8, Sensitivity Analysis of Firm Value Before Leverage Discount Rate 1% 1% 2% Average 9/9 6.9 (1, (1, (1, Sugar Price Hist. 7.0 (8, (8, (7, +5% 8.0 (7,0) (7, (6,6 The terminal value is th| Model Type | Helical gear box H2 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 13000.000000 |

| Ratio Range | 1 : 7.1…22.4 |

| Low Speed Output | Flanged shaft |

| Nominal Torque | 725000 Nm |

| Mounting Arrangements | Horizontal mounting position |

| Manufacturer | A. Friedr. Flender GmbH |

| Country of Manufacture | China |

| Data Sheet & Drawings | H2-FH24A flender car Helical gear box H2 |