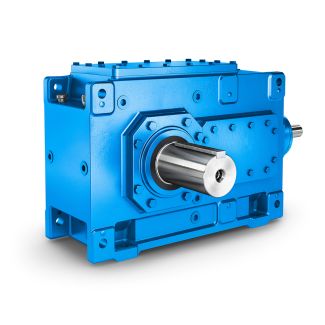

Helical gear reducer H2 acoplamiento flender H2-CV3-B

In stock

SKU

H2-CV3-B

$2,742.86

Flender/Flender Gear Units/Helical gear reducer H2

4 1/9 1/9 1/9 1/9 1/9 1/9 VJ Land (Manzanas) 8,6 5,1 8,1 1,5 1,5 1,5 Dolono Land (Manzanas) 2,4 8,2 8,2 9,4 9,4 9,4 rotal Land (Manzanas) 1,1 1,3 1,3 2,0 2,0 2,0 ,gricultural Yield (Tons/Man:-ana) 3.2 4.8 5.5

8,2 8,2 9,4 9,4 9,4 rotal Land (Manzanas) 1,1 1,3 1,3 2,0 2,0 2,0 ,gricultural Yield (Tons/Man:-ana) 3.2 4.8 5.5  5.5 5.5 5.5 Dane Harvested (Tons) 2,6 2,9 4,6 5,3, 5,3 5,3 .,ane Purchased (Tons) 8,7 3,2 4,6 4,6 4,6

5.5 5.5 5.5 Dane Harvested (Tons) 2,6 2,9 4,6 5,3, 5,3 5,3 .,ane Purchased (Tons) 8,7 3,2 4,6 4,6 4,6  4,6 Fotat Cane (Tons) 3,4 5,2 8,3 1,0,0 1,0,0 1,0,0 industrial Yield (Quintals/Ton) 2.2 2.2 2.2 2.2 2.2 2.2 Sugar

4,6 Fotat Cane (Tons) 3,4 5,2 8,3 1,0,0 1,0,0 1,0,0 industrial Yield (Quintals/Ton) 2.2 2.2 2.2 2.2 2.2 2.2 Sugar  Produced (Quintals) 7,7 1,2,5 1,8,6 2,3,0 2,3,0 2,3,0 Average Personnel 1,8 1,7 1,5 1,5 1,5 1,5 Field Cost Per Ton ($US) $2.3 $2.3 $1.5 $1.6 $1.6 $1.6 Cash Operat. Cost Per Quintal ($US) $2.4 $1.2 $1.4 $1.6 $1.6 $1.6 1/9 1/9 1/9 1/9 1/9 1/9 REVENUES 1 7 1,3 1,5 1,5 1,5 OPERATING COSTS Field Costs Factory Costs Administrative Costs Depreciation 5,6 2,1 1,5 4,3 7,2 2,6 1,3 5,7 8,2 3,9 1,3 1,1 8,2 3,9 1,3 1,8 8,2 3,9 1,3"1 1,2 Total 1,7 1,9 1,6 1,3 1,7 PROFIT BEFORE TAX ( 3,4 4,8 4,1 4,8 TAX 2,2 1,6 1,3 1,1 1,7 PROFIT AFTER TAX (3, 2,7 3,5 2,9 2,0 DEPRECIATION (+) 4,3 5,7 1,1 1,8 1,2 CAPITAL EXPENDITURES (-) 1,0 3,3 4,3 1,0 1,0 NCREAS IN NETWORKING CAPITAL (-) 6,8 1,2 9,5 0 0 CASH FLOW BEFORE LEVERAGE (1, (1, (8, 3,8 3,3 NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% 4,7 TERMINAL VALUE * 1,2 NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% 9,1 FIRM VALUE BEFORE LEVERAGE 9,9 Sensitivity Analysis of Firm Value Before Leverage Discount Rate 1% 1% 2% Average 9/9 6.9 5,9 2,5 1,6 Sugar Price Hist. 7.0 1,6 9,9 6,1 +5% 8.0 1,5 1,9 8,1 The termial value is the greater of zero and the 1/9 cash flow divided by the discount rate. Ingenio Victoria de Julio Cash Flow Projections (Cordobas) jVJ Land (Manzanas) Polono Land (Manzans) Total Land (Manzanas) ricultural Yield (Tons/Manzana) Cane Harvested (Tons) Cnne Purchased (Tons) Total Cane (Tons) Industrial Yield (Quintals/Ton) Bugar Produced (Quintals) Average Personnel REVENUES Sugar Molasses Electric Generation Total FIELD COSTS Salares & Benefits Purchase of Cane Materials Agrnch

Produced (Quintals) 7,7 1,2,5 1,8,6 2,3,0 2,3,0 2,3,0 Average Personnel 1,8 1,7 1,5 1,5 1,5 1,5 Field Cost Per Ton ($US) $2.3 $2.3 $1.5 $1.6 $1.6 $1.6 Cash Operat. Cost Per Quintal ($US) $2.4 $1.2 $1.4 $1.6 $1.6 $1.6 1/9 1/9 1/9 1/9 1/9 1/9 REVENUES 1 7 1,3 1,5 1,5 1,5 OPERATING COSTS Field Costs Factory Costs Administrative Costs Depreciation 5,6 2,1 1,5 4,3 7,2 2,6 1,3 5,7 8,2 3,9 1,3 1,1 8,2 3,9 1,3 1,8 8,2 3,9 1,3"1 1,2 Total 1,7 1,9 1,6 1,3 1,7 PROFIT BEFORE TAX ( 3,4 4,8 4,1 4,8 TAX 2,2 1,6 1,3 1,1 1,7 PROFIT AFTER TAX (3, 2,7 3,5 2,9 2,0 DEPRECIATION (+) 4,3 5,7 1,1 1,8 1,2 CAPITAL EXPENDITURES (-) 1,0 3,3 4,3 1,0 1,0 NCREAS IN NETWORKING CAPITAL (-) 6,8 1,2 9,5 0 0 CASH FLOW BEFORE LEVERAGE (1, (1, (8, 3,8 3,3 NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% 4,7 TERMINAL VALUE * 1,2 NET PRESENT VALUE FLENDER GRAFFENSTADEN 1% 9,1 FIRM VALUE BEFORE LEVERAGE 9,9 Sensitivity Analysis of Firm Value Before Leverage Discount Rate 1% 1% 2% Average 9/9 6.9 5,9 2,5 1,6 Sugar Price Hist. 7.0 1,6 9,9 6,1 +5% 8.0 1,5 1,9 8,1 The termial value is the greater of zero and the 1/9 cash flow divided by the discount rate. Ingenio Victoria de Julio Cash Flow Projections (Cordobas) jVJ Land (Manzanas) Polono Land (Manzans) Total Land (Manzanas) ricultural Yield (Tons/Manzana) Cane Harvested (Tons) Cnne Purchased (Tons) Total Cane (Tons) Industrial Yield (Quintals/Ton) Bugar Produced (Quintals) Average Personnel REVENUES Sugar Molasses Electric Generation Total FIELD COSTS Salares & Benefits Purchase of Cane Materials Agrnch| Model Type | Helical gear reducer H2 |

|---|---|

| Gear Type | Helical Gear |

| Weight (kg) | 128.000000 |

| Ratio Range | 1 : 6.3...22.4 |

| Low Speed Output | Solid shaft without parallel key |

| Nominal Torque | 3500 Nm |

| Mounting Arrangements | Vertical mounting position |

| Manufacturer | Flender France S.A.R.L. |

| Country of Manufacture | Germany |

| Data Sheet & Drawings | Helical gear reducer H2 acoplamiento flender H2-CV3-B |