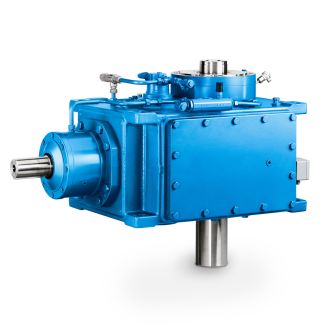

oilwater cooler in the oil circuit see page GS B4KH-15-C Bevel-helical speed reducer B4

In stock

SKU

B4KH-15-C

$77,785.71

Flender/Flender Gear Units/Bevel-helical speed reducer B4

us as public enterprise under the Reforma Agraria also makes this option infeasible. Thus, there are five potential options that may be appropriate for the privatization of IVJ: sale of assets, joint vent-ure, liquidation, management/employee buyout, and management contract or

may be appropriate for the privatization of IVJ: sale of assets, joint vent-ure, liquidation, management/employee buyout, and management contract or  lease. Option 1: Sale of Assets Under Option 1, CORNAP would sell the assets of IVJ as going concern to

lease. Option 1: Sale of Assets Under Option 1, CORNAP would sell the assets of IVJ as going concern to  an investor group with experience in the industry. The liabilities of IVJ would remain with the Government. The responsibility for

an investor group with experience in the industry. The liabilities of IVJ would remain with the Government. The responsibility for  severance benefits would also remain with the government, but would partially offset employees' payment for their option to buy 2% of the State' holding in IJB. The investors would form new company, which would be set up at the time of the sale, with IVJ' assets and continue to operate the mill. As first step in this sale, CORNAP would negotiate with the workers to determine if they are interested in exercising their 2% option in specific assets. Assets purchased by employees would be set up in an employee-owned company. The remaining assets would be sold to investors as described above. The advantages of this approach are as follows: * Ownership of IVJ is transferred to private owner which eliminates the responsibility of the Government for financial losses and further capital investments. Private, experienced owners have strong incentive to improve management and operations. IVJ continues to be operated as going concern and employment is maintained, although probably at lower level. Cash is generated for the Government in the short-term. The disadvantages of Option 1 are as follows: * The Government may receive lower price if the mill is expected to continue as going concern rather than be liquidated. As noted in Section VIII, the ongoing concern value of IVJ is estimated at $9 to IX -2 $2 million while the cash liquidation value is estimated at $3 million. * Private investor interest in IVJ may not be strong give

severance benefits would also remain with the government, but would partially offset employees' payment for their option to buy 2% of the State' holding in IJB. The investors would form new company, which would be set up at the time of the sale, with IVJ' assets and continue to operate the mill. As first step in this sale, CORNAP would negotiate with the workers to determine if they are interested in exercising their 2% option in specific assets. Assets purchased by employees would be set up in an employee-owned company. The remaining assets would be sold to investors as described above. The advantages of this approach are as follows: * Ownership of IVJ is transferred to private owner which eliminates the responsibility of the Government for financial losses and further capital investments. Private, experienced owners have strong incentive to improve management and operations. IVJ continues to be operated as going concern and employment is maintained, although probably at lower level. Cash is generated for the Government in the short-term. The disadvantages of Option 1 are as follows: * The Government may receive lower price if the mill is expected to continue as going concern rather than be liquidated. As noted in Section VIII, the ongoing concern value of IVJ is estimated at $9 to IX -2 $2 million while the cash liquidation value is estimated at $3 million. * Private investor interest in IVJ may not be strong give| Model Type | Bevel-helical speed reducer B4 |

|---|---|

| Gear Type | Bevel Helical Gear |

| Weight (kg) | 3630.000000 |

| Ratio Range | 1 : 80…315 |

| Low Speed Output | Hollow shaft with spline acc. to DIN 5480 |

| Nominal Torque | 153000 Nm |

| Mounting Arrangements | Horizontal mounting position |

| Manufacturer | Flender Ges.m.b.H. |

| Country of Manufacture | Japan |

| Data Sheet & Drawings | oilwater cooler in the oil circuit see page GS B4KH-15-C Bevel-helical speed reducer B4 |